Free Scanned Letters - Worth £40 ! Learn more

UK VAT Registration - Who Needs To Get It

UK VAT Registration: What It Is, Who Needs To Get It And How To Get It

VAT (Value Added Tax) is the UK sales tax. It's simply a way for the government to get more money from its subjects. If you make more than £X in sales, you have to charge VAT at Y%. Y is currently 20 at the standard rate, at the time of writing.

If a VAT-registered business is itself charged VAT in the course of doing business , it can usually reclaim it from the taxman. This recovery is vital to companies doing business with other VAT-registered companies.

If the entity is not VAT-registered, then it normally cannot.

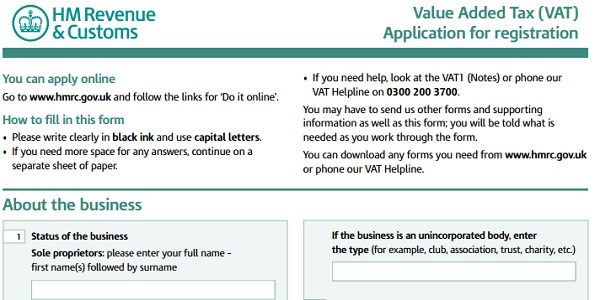

Her Majesty's Revenue Commissioners, aka HMRC, aka The Taxman put it quite succinctly on their website. (NOTE: The threshold is correct as at 13.8.2015):

"You must register when you go over the threshold, or know that you will. The threshold is based on your VAT taxable turnover - the total of everything sold that isn’t VAT exempt.

...

if:

- Your VAT taxable turnover is more than £85,000 (the ‘threshold’) in a 12 month period;

- You receive goods in the UK from the EU worth more than £85,000;

- You expect to go over the threshold in a single 30 day period.

...

There’s no threshold if neither you nor your business is based in the UK. You must register as soon as you supply any goods and services to the UK (or if you expect to in the next 30 days).

You may have to register for VAT if you take over a business that’s already registered.

Late registration

You must register within 30 days of your business turnover exceeding the threshold. If you register late, you must pay what you owe from when you should have registered.

You may get a penalty depending on how much you owe and how late your registration is.

Voluntary registration

You can register voluntarily if your business turnover is below £82,000. You must pay HMRC any VAT you owe from the date they register you.

Get an exception

You can apply for a registration ‘exception’ if your taxable turnover goes over the threshold temporarily.

Write to HMRC with evidence showing why you believe your VAT taxable turnover won’t go over the de-registration threshold of £80,000 in the next 12 months.

HMRC will consider your exception and write confirming if you get one. If not, they’ll register you for VAT."

Here is the link:

https://www.gov.uk/government/publications/vat-application-for-registration-vat1

Should I register?

If you sell mainly to non-VAT registered businesses/people, then no.

If you sell mainly to VAT registered businesses then, yes.

VAT adds 20% to your sales price. It creates extra accounting work. You only register when it's compulsory and/or you can claim it back.

What mailing address should I use?

The following paragraph in the form above confuses some of our clients:

"Business contact details

Business address, that is, the principal place where most of the day to day running of the business is carried out ..."

They think the can use our address in this box. We regret that is not so. That box is for your trading address, the address where you actually work at/in your business. It can be your home or a business unit. It can be a foreign address.

The taxman wants to know where he can find you. It's reasonable. Where is this business actually operating from?

We do not recommend you be too clever here. You could only really use our address in that box if you were renting a desk at one of our offices, which you can do here:

http://www.hotdeskingclub.com/join-club

In conclusion, a UK business whose turnover goes over the threshold has to register for VAT. At this point, you must get an accountant, if you don't already have one. It's too much trouble to do it oneself, even if one has significant accounting knowledge. VAT is simply a fact of life of doing business in the UK.

Go Paperless

Go Paperless